For instance, consider a company that receives legal services in December but doesn’t receive the invoice until January. Under accrual accounting, the company would record the legal expenses as an accrued charge in December, the month when the service was provided, rather than in January when the invoice is received and paid. This approach provides a more accurate reflection QuickBooks of the company’s obligations and expenses during the period in which they were incurred. Let’s say a company pays salaries to its employees on the first day of the following month for services received in the prior month. The accrued expenses from the employees’ services for December will be omitted if the company’s income statement at the end of the year recognizes only salary payments that have already been made.

What Is the Journal Entry for Accrued Expenses?

The expenses are recorded on an income statement, with a corresponding liability on the balance sheet. Accrued expenses are usually current liabilities since the payments are generally due within one year from the transaction date. Although it is easier to use the cash method of accounting, the accrual method can reveal a company’s financial health more accurately. It allows companies to record their sales and credit purchases in the same reporting period when the transactions occur. By considering these points, businesses can ensure they handle accrued charges in a legally compliant and efficient manner, thereby avoiding potential financial and legal pitfalls. This requires a robust system that can handle complex calculations and maintain compliance across different jurisdictions.

Accrued Charges Definition:

Accrual accounting presents a more accurate measure of a company’s transactions and events for each period. Cash basis accounting often results in the overstatement and understatement of income and account balances. In essence, accrued charges are a fundamental aspect of financial accounting, ensuring that businesses accurately report their expenses and liabilities in a timely manner. By adhering to proper accrual accounting principles, businesses maintain financial integrity and transparency, crucial for stakeholders and regulatory compliance.

What Are Examples of Accounts Payable?

- The adjusting entry will be dated Dec. 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet.

- Meanwhile, a CFO views these technological solutions as a means to enhance transparency and compliance, reducing the risk of financial misstatements and the effort involved in audit processes.

- The accrual method of accounting requires revenues and expenses to be recorded in the period that they are incurred, regardless of the time of payment or receiving cash.

- Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement.

- It is typically presented as a short-term asset, since most prepaid expenses will be consumed within a short period of time.

Part of this rhythm includes recording expenses in one of two ways (cash or accrual). A popular choice is through accrued expenses, in which you account for a future charge before it is actually invoiced. The main advantage of recording accrued expenses is that they enhance the accuracy of a reporting entity’s financial statements.

![]()

A financial controller, on the other hand, might emphasize the importance of forecasting and budgeting for these expenses to ensure that funds are available when payments are due. Meanwhile, a business owner would be interested in strategies that optimize cash flow while still meeting all financial obligations. Thus, if the amount of the office supplies were $500, the journal entry would be a debit of $500 to the office supplies expense account and a credit of $500 to the accrued expenses liability account. Accrued charges represent a fundamental concept in accounting and financial management, reflecting expenses that have been incurred but not yet paid. This concept is crucial for businesses as it ensures that financial statements provide a complete and accurate picture of the company’s financial health.

What is an Accrued Expense?

- For companies that are responsible for external reporting, accrued expenses play a big part in wrapping up month-end, quarter-end, or fiscal year-end processes.

- Accrued payments, often a significant line item on a company’s balance sheet, represent expenses that have been incurred but not yet paid.

- By utilizing a centralized accrual management system, the corporation can ensure consistency across all regions, while also adapting to local requirements.

- Consider an example where a company enters into a contract to incur consulting services.

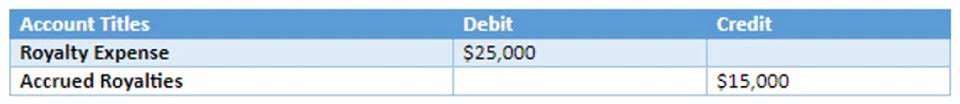

- Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account.

For instance, you’re likely using electricity to power some part of your business. Every month you account for an electric bill before you know exactly how much energy is being used. Accrued expense is a concept in accrual accounting that refers to expenses that are recognized when incurred but not yet paid. To illustrate an accrued expense, let’s assume that a company borrowed $200,000 on December 1. The agreement requires that the company repay the $200,000 on February accrued charges 28 along with $6,000 of interest for the three months of December through February.

- Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future.

- For the financial analyst, it translates to having access to detailed forecasts and models that predict future accruals based on historical data and current trends.

- A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future.

- With experienced CPAs and bookkeepers, QuickBooks accounting software offers expert help to assist you in keeping track of your accruals or your cash expenses so each close period is more streamlined.

- This approach provides a more accurate reflection of the company’s obligations and expenses during the period in which they were incurred.

- Accounts payable is not an accounting practice—it’s part of an accounting process for accrual accounting methods.

- Companies incur rent as an accrued expense because this is a cost that’s paid consistently and monthly.

Reversing Entries

CFI is on a mission to enable anyone https://www.bookstime.com/articles/form-w8 to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

Consequently, a prepaid asset initially appears on the balance sheet as an asset. It is typically presented as a short-term asset, since most prepaid expenses will be consumed within a short period of time. From the perspective of a small business owner, accrual accounting allows for a more accurate picture of financial health and long-term profitability. It can help in identifying trends in sales and expenses that cash accounting might obscure. For instance, if a company makes a large sale in December but doesn’t receive payment until January, cash accounting would show a huge profit in January even though the sale was made the previous year. Accrual accounting measures a company’s performance and position by recognizing economic events regardless of when cash transactions occur, whereas cash accounting only records transactions when payment occurs.

Accrued expenses and prepaid expenses

Also called accrued liabilities, these expenses are realized on a company’s balance sheet and are usually current liabilities. Accrued liabilities are adjusted and recognized on the balance sheet at the end of each accounting period. Any adjustments that are required are used to document goods and services that have been delivered but not yet billed. Accrued expenses are expenses that have already been incurred, but for which no billing documentation has yet been received. This differs from accounts payable, which are obligations to pay, based on invoices received from suppliers and recorded in the accounting system. First, an accrued expense has no supporting invoice from a supplier, while an account payable is supported by a supplier invoice.